April 17, 2014

Americans Sold on Real Estate as Best Long-Term Investment

Lower-income Americans prefer gold to stocks, savings accounts, bonds

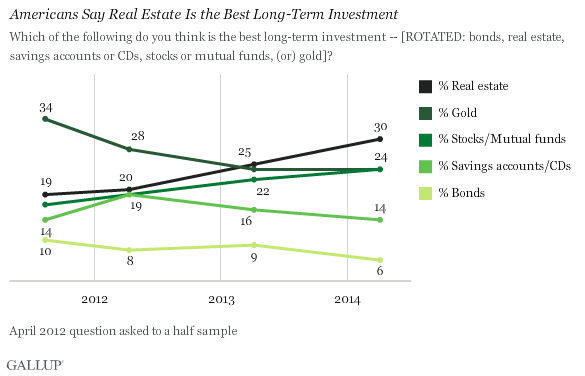

WASHINGTON, D.C. -- Americans today are more likely to think real estate is the best option for long-term investments than in the past, ranking it ahead of gold and stocks.

These results are from Gallup's April 3-6 Economy and Personal Finances poll that asked Americans to choose the best option for long-term investments: real estate, stocks and mutual funds, gold, savings accounts and CDs, or bonds. Prior to 2011, Gallup asked the same question, but did not include gold as an option.

Gold was the most popular long-term investment among Americans in 2011 -- a time when gold was at its highest market price and real estate and stock values were lower than they are today. Gold prices dropped significantly after that and it lost favor with Americans. The 24% of Americans who currently name gold as the best long-term investment ties with the 24% who choose stocks.

Bonds have been Americans' least favored investment option for as long as Gallup has been asking the question. Savings accounts and CDs, on the other hand, have been more popular in the past. In September 2008, before gold was an option and at a time when the real estate and stock markets were tanking, savings accounts were the most popular long-term investment among Americans.

This year, the housing market has been improving across the U.S., and home prices have recently been rising after a steep drop in 2007 during the subprime mortgage crisis. This current improvement in prices may be why more Americans now consider real estate the best option for long-term investments. In 2002, during the real estate boom that preceded the mortgage crisis and before gold was offered as an option in the question, half of Americans said real estate was the best investment choice.

Stock values have also been improving in recent years, aided particularly by the bull market in 2013. The 24% of Americans who regard stocks as the best long-term investment is also higher now, up from 19% in 2012. Still, Americans are modestly more likely to say real estate is the better investment today, perhaps because of the recent volatility in the stock market.

Lower-Income Americans the Only Subgroup to Favor Gold

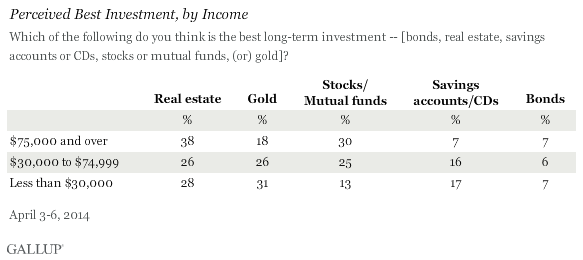

Lower-income Americans, those living in households with less than $30,000 in annual income, are the most likely of all income groups to say gold is the best long-term investment choice, at 31%. Upper-income Americans are the least likely to name gold, at 18%.

Upper-income Americans are much more likely to say real estate and stocks are the best investment, possibly because of their experience with these types of investments. Upper-income Americans are most likely to say they own their home, at 87%, followed by middle (66%) and lower-income Americans (36%). Gallup found that homeowners (33%) are slightly more likely than renters (24%) to say real estate is the best choice for long-term investments.

Stock investors are also more likely to favor stocks as the best long-term investment; 34% of them say that stocks are the best option compared with 13% of Americans who don't own stocks. Upper-income Americans are again the most likely to own stocks (82%), followed by middle-(57%) and lower-income Americans (16%).

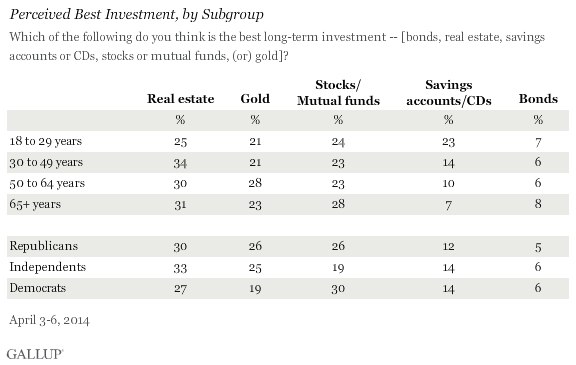

Young Americans Place More Faith in Savings Accounts and CDs

Americans between 18 and 29 years old are almost evenly split, with about one-quarter each saying real estate, stocks, gold, and savings accounts are the best choices for long-term investments. However, the 23% who said savings accounts is much higher than the percentage who gave this same answer in older age groups.

These differences again could reflect actual home ownership and familiarity with the real estate purchasing process. Less than 30% of Americans between 18 and 29 years own their home, compared with 68% of 30- to 49-year-olds, 73% of 50- to 64-year-olds, and 83% of those aged 65 and older. Younger Americans could favor savings accounts because they've largely become financially independent adults during a time of volatile housing and stock markets. This age group's relative preference to savings accounts is in line with findings from 2013.

Implications

With housing prices improving across the country, Americans are regaining faith that real estate is the best choice for long-term investments. But home ownership is also associated with views of real estate as an attractive investment opportunity. This leaves groups with lower home ownership rates, like lower-income and younger Americans, still looking elsewhere for investment options.

Likewise, stock values have been improving and Americans are more likely now than in recent years to say stocks are the best investment, though more still choose real estate. That could be partly attributable to more Americans owning a home than owning stocks, but could also be related to recent volatility in stocks this year, especially during the time the survey was conducted.

Different investment options historically offer different levels of risk and different rewards. Savings accounts and bonds are historically safe, but do not offer as high of returns, and Americans typically don't regard those as the best investments. While stocks can be more volatile, they also can offer huge returns. What Americans view as the best choice for investing reflects myriad factors and is influenced by how the investment is currently performing and respondents' biases toward where they are invested.

Survey Methods

Results for this Gallup poll are based on telephone interviews conducted April 3-6, 2014, with a random sample of 1,026 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, the margin of sampling error is ±4 percentage points at the 95% confidence level.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, and cellphone mostly). Demographic weighting targets are based on the most recent Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the most recent National Health Interview Survey. Population density targets are based on the most recent U.S. census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit www.gallup.com.

Sign up for Gallup e-mail alerts or RSS feeds

2. Cleaner, contemporary lines. Styles fade in and out, typically following suit with fashion trends and the economy. This year, home owners are gravitating away from traditional and even eclectic designs, instead opting for streamlined, modern looks, says Petrie. This preference is showing up in less-ornamented cabinet fronts, sometimes with a flat door or minimal molding and simpler hardware. Trends also include less exotic countertop patterns, simpler floor choices such as wood planks or bigger tiles with less grout, and pared-back color palettes.

2. Cleaner, contemporary lines. Styles fade in and out, typically following suit with fashion trends and the economy. This year, home owners are gravitating away from traditional and even eclectic designs, instead opting for streamlined, modern looks, says Petrie. This preference is showing up in less-ornamented cabinet fronts, sometimes with a flat door or minimal molding and simpler hardware. Trends also include less exotic countertop patterns, simpler floor choices such as wood planks or bigger tiles with less grout, and pared-back color palettes. 3. Open wide. Whether it’s small or large, a kitchen that opens to other rooms — including the outdoors — offers space to cook. Clients could consider the different zones of a kitchen, such as eating and living space, says designer Jeff Collé of Estates by Collé in East Hampton, N.Y. His upscale remodeled kitchens often feature fireplaces, TVs, sound systems, and butler’s pantries — they’re now referred to as “caterer’s kitchens” since they include space and equipment to cook and clean up.

3. Open wide. Whether it’s small or large, a kitchen that opens to other rooms — including the outdoors — offers space to cook. Clients could consider the different zones of a kitchen, such as eating and living space, says designer Jeff Collé of Estates by Collé in East Hampton, N.Y. His upscale remodeled kitchens often feature fireplaces, TVs, sound systems, and butler’s pantries — they’re now referred to as “caterer’s kitchens” since they include space and equipment to cook and clean up. 4. White still tops. While white continues to maintain its front-runner status because of its classic chic connotation, gray has increased in popularity, showing up in stained and painted cabinets and countertops fabricated from quartz, quartzite, limestone, granite, and marble with lots of gray veining. If home owners are making choices for a kitchen where they’ll live for years, opting for gray makes sense, but if they’re making improvements to sell, it may be smarter to stay with more buyers’ preference for white. Despite conventional wisdom, some pops of color can liven up a kitchen.

4. White still tops. While white continues to maintain its front-runner status because of its classic chic connotation, gray has increased in popularity, showing up in stained and painted cabinets and countertops fabricated from quartz, quartzite, limestone, granite, and marble with lots of gray veining. If home owners are making choices for a kitchen where they’ll live for years, opting for gray makes sense, but if they’re making improvements to sell, it may be smarter to stay with more buyers’ preference for white. Despite conventional wisdom, some pops of color can liven up a kitchen. %20copy.jpg) 5. Wood neck-to-neck with porcelain tile. These two choices command the greatest attention for flooring. Both are easy on feet and highly durable, and many porcelain tiles mimic wood so well they’re hard to differentiate. For those who favor wood, narrower widths are in again — 2 to 3 inches typically fit contemporary taste; for those who prefer porcelain, bigger tiles — 12 by 24 inches — are making inroads.

5. Wood neck-to-neck with porcelain tile. These two choices command the greatest attention for flooring. Both are easy on feet and highly durable, and many porcelain tiles mimic wood so well they’re hard to differentiate. For those who favor wood, narrower widths are in again — 2 to 3 inches typically fit contemporary taste; for those who prefer porcelain, bigger tiles — 12 by 24 inches — are making inroads.PRO36%206%20GAS%20GI%20copy.jpg) 7. Induction, steam ovens, microwave drawers, and more.There’s lots happening on the appliance front; some trends have been around but are increasing in popularity, while others are brand new. But a modern layout continues to separate cooking equipment so multiple cooks can work together without getting in each other’s way.

7. Induction, steam ovens, microwave drawers, and more.There’s lots happening on the appliance front; some trends have been around but are increasing in popularity, while others are brand new. But a modern layout continues to separate cooking equipment so multiple cooks can work together without getting in each other’s way. Steam ovens that cook faster and allow for healthier food preparation, along with a second convection oven; some steam ovens include a cleaning function that permits spills to be removed without heating and smelling up a kitchen for hours, says Hood.

Steam ovens that cook faster and allow for healthier food preparation, along with a second convection oven; some steam ovens include a cleaning function that permits spills to be removed without heating and smelling up a kitchen for hours, says Hood. Dishwashers that have three and four racks for silverware and utensils; also, models that use less water, are quieter and bigger, and place jets along side walls.

Dishwashers that have three and four racks for silverware and utensils; also, models that use less water, are quieter and bigger, and place jets along side walls. 9. Glass splash and more. Backsplashes have become a major focal point; subway tiles are still popular, though now with beveled edges; matte rather than glossy finishes; a variety of colors rather than just classic white; and in larger 4-by-10-inch formats rather than traditional 3-by-6-inch sizes. Today’s trend is also to lay the tiles in vertical rather than horizontal rows. Bigger glass tiles in shimmery hues are grabbing attention, too—and they represent a green choice, made out of recycled materials. Another option is handcrafted tiles with an Art Deco and Frank Lloyd Wright influence.

9. Glass splash and more. Backsplashes have become a major focal point; subway tiles are still popular, though now with beveled edges; matte rather than glossy finishes; a variety of colors rather than just classic white; and in larger 4-by-10-inch formats rather than traditional 3-by-6-inch sizes. Today’s trend is also to lay the tiles in vertical rather than horizontal rows. Bigger glass tiles in shimmery hues are grabbing attention, too—and they represent a green choice, made out of recycled materials. Another option is handcrafted tiles with an Art Deco and Frank Lloyd Wright influence. 10. LED lighting. Because it’s been mandated by certain states and the federal government has required that incandescent lamps be phased out unless sufficiently energy efficient, more professionals and home owners are making the switch to energy-wise LEDs underneath cabinets and in cans, pendants, chandeliers, and sconces. Costs have come down for LEDs, and lighting trends lean toward fewer but larger pendants above islands and more decorative fixtures above tables.

10. LED lighting. Because it’s been mandated by certain states and the federal government has required that incandescent lamps be phased out unless sufficiently energy efficient, more professionals and home owners are making the switch to energy-wise LEDs underneath cabinets and in cans, pendants, chandeliers, and sconces. Costs have come down for LEDs, and lighting trends lean toward fewer but larger pendants above islands and more decorative fixtures above tables. 12. Eating in and cooking out. An eating area is more de rigueur, whether it’s a big table, a corner banquette with a table, or a countertop. And outdoor kitchens, with varying dimensions depending on climate and budgets, remain popular. Many home owners no longer want the full panoply of outdoor appliances, which were often underutilized and overpriced; a good grill sometimes may be sufficient.

12. Eating in and cooking out. An eating area is more de rigueur, whether it’s a big table, a corner banquette with a table, or a countertop. And outdoor kitchens, with varying dimensions depending on climate and budgets, remain popular. Many home owners no longer want the full panoply of outdoor appliances, which were often underutilized and overpriced; a good grill sometimes may be sufficient.

inShare